The U.S. economy presents an unpredictable picture: when prices are soaring and products are in short supply, the number of jobs is almost the highest, but actual recruitment has dropped sharply, which have caused the U.S. economic recovery to be unexpectedly turbulent. In fact, a new wave of epidemics caused by the delta variant reached its peak in September. Although it was mitigated later, the combination of supply chain crises, energy crises, and high inflation caused the concerns that the U.S. economy would fall into “stagflation” have risen sharply.

Many people who work on Wall Street pointed out that the current high inflation and weak employment do not necessarily mean stagflation. After all, the central bank has learned the lessons of the past. Different from the “stagflation” in the 1970s, some of the current risks of stagflation have been priced by the market.

The inflation rate in the United States has remained at a high level of over 5% for four consecutive months from May to August this year. Similarly, inflation in Europe has also created a new high in more than a decade. The latest World Economic Outlook published by the International Monetary Fund (IMF) raised the global inflation forecast for 2021 from 2.4% to 2.8%, and dedicated a chapter to warn about inflation trends, believing that once inflation continues rising, policymakers need to act decisively.

At the end of September, global monetary policymakers such as the Chairman of the Federal Reserve and the President of the European Central Bank expressed that the “transitory” high inflation is now likely to last longer. In a speech at an online event in mid-October, the chairman of the Federal Reserve Bank of Atlanta said that the Fed has set up a “swear jar”, and anyone has to put a dollar in every time he uses the dreaded word “transitory”. Then he said seriously that h the Atlanta Fed and himself believe that it is better to use the term “episodic” to describe today’s inflation rather than “transitory”.

US non-agricultural employment unexpectedly weakened in September, with an addition of only 194,000 people, which was significantly lower than the 500,000 people expected by the market. After the data was released, the market was betting on the weakening of the US economy and loose monetary policy in the short term, but this sentiment quickly dissipated within one hour. The 10-year US Treasury yield fell to around 1.56% in the short-term, then rebounded strongly and broke 1.6%, and closed at 1.618% on the day. The US dollar index plunged below 94 in the short term, then rose to above 94, and closed at 94.1 on the day. U.S. stocks that opened after trading experienced volatility and closed down slightly.

Many Fed officials believe that despite the weak employment data in September and only 194,000 new jobs in the United States, the labor market is expected to continue to recover with the epidemic recently mitigated and maintaining strong demand. Therefore, the sooner the Fed scales back its debt purchases, the situation would be better.

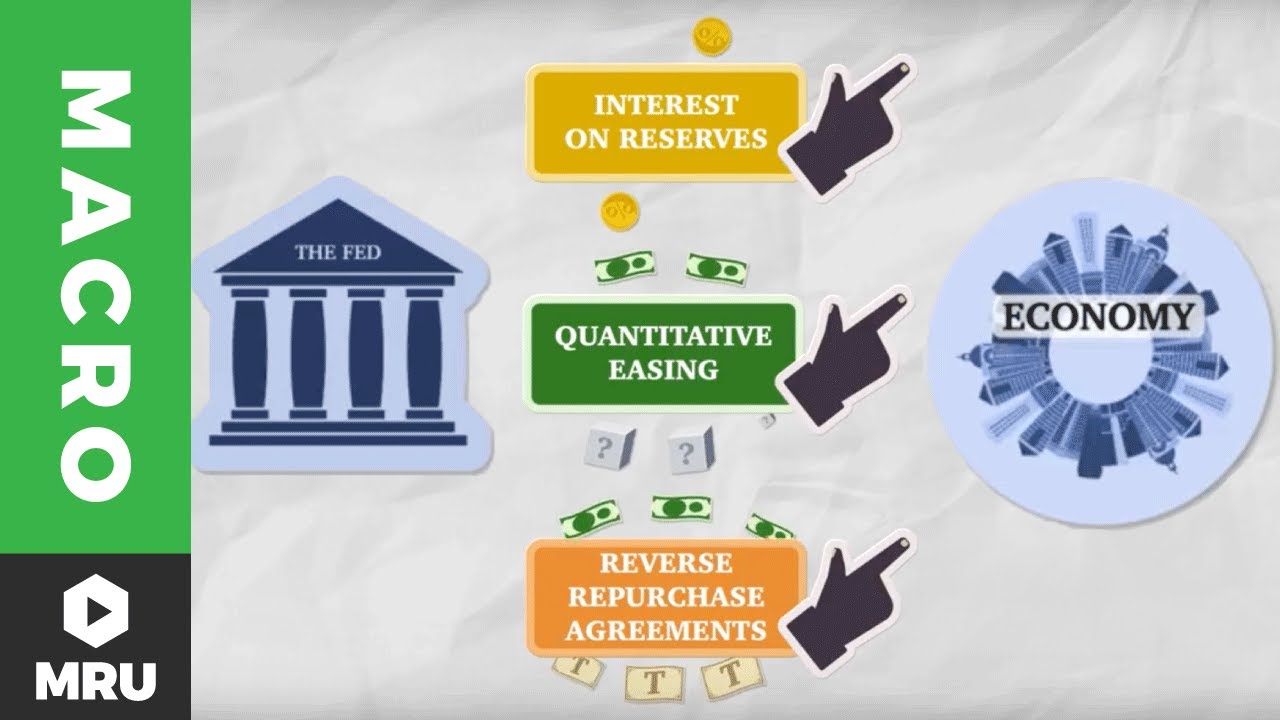

On October 13, local time, the Fed published the minutes of the September Federal Open Market Committee (FOMC) meeting, further stabilizing the Fed’s expectation that it will reveal a “gradual cut in bond-buying” in three weeks. The minutes indicate that the Fed may begin to reduce monthly asset purchases as early as mid-November. Some participants also raised the possibility of increasing the target range of interest rates before the end of next year.