There is a belief that if you want to start investing in the stock market, you need a large amount of money right away. That's not the case. You don't even need to buy a total share of stock to get started.

Fractional share investment allows you to make a single, commission-free stock purchase for as little as $5 or $10. One of these finest fractional share investing brokerages may be suitable for you, whether you're just starting, teaching your kids how to invest, or building a more varied portfolio.

What Are Fractional Shares?

A fractional share is a firm's share that is worth less than one whole share. Purchasing a fractional share allows you to invest in a firm without putting up the total value of the total share. Stocks may be purchased for as little as $5 or $10, making it possible to start investing in stocks at any time rather than saving for the total value of a share or multiple shares.

How Do Fractional Shares Operate?

Fractional shares enable smaller investors to participate in significant company stock purchases, which they would otherwise be excluded from if they had to pay the total share price. Some corporations have stock prices over $1,000, which are unattainable for many investors.

The New York Stock Exchange (NYSE) and most other stock exchanges demand that you purchase a whole stock to trade. Shares in some of the most successful public firms will be purchased by several brokerages, distributing among their investors.

What Sorts of Brokerages Provide Fractional Shares?

Fractional share purchases aren't available at all brokerages. Several non-traditional financial institutions provide this form of investment, but they are not usually the big-name brokerages or investment organizations. Despite this, more and more people are embracing these alternatives regularly.

What Are Fractional Shares Worth?

For a fractional share, the minimum investment amount varies per brokerage, although most demand a minimum of $5. Each trade's brokerage fee will be different, so keep an eye on that. Depending on the broker, per-trade fees can run the gamut from $1 to more than $5. Others provide free stock transactions or charge a monthly subscription to use their platform for unlimited trades.

Investing in Fractional Shares Has Several Advantages

Investing in fractional shares has several advantages. The New York Stock Exchange, for example, demands that you acquire at least one share at a time on the exchange. Many smaller investors would be excluded from the action if companies like Alphabet, Amazon, or Berkshire Hathaway went public.

When investing in fractional shares, you can use whatever assets you have on hand to purchase these or any other equities.

How We Picked the Best Fractional Share Brokers

Over a dozen investment organizations were analyzed to develop this list of the finest brokerages. Brokerages must provide commission-free transactions and platforms accessible to the average investor outside of managed investing services. Additionally, we looked at the price, platforms, the number of investments supported for fractional shares, and the ability to trade fractional shares.

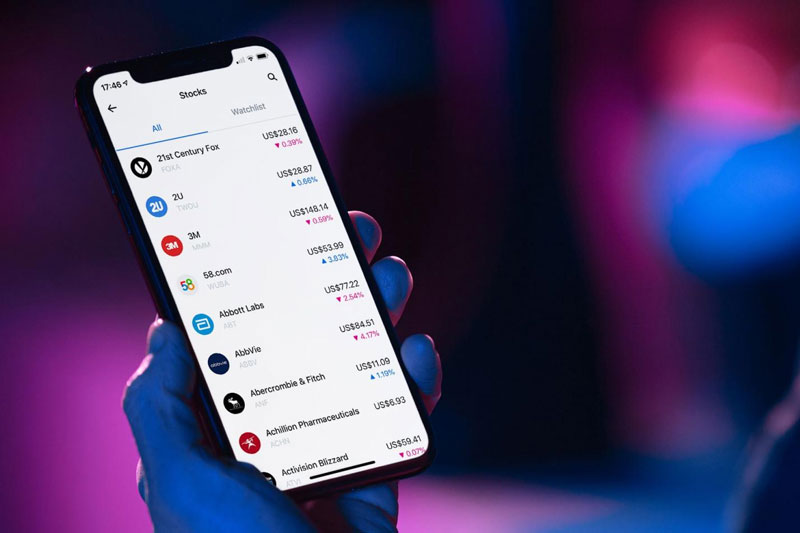

Top Fractional Share Brokers in April 2022

· Charles Schwab

As an investor-focused company, Charles Schwab has long been able to provide investors the ability to acquire fractional shares of any stock in the Standard &''' Poor's 500 Index starting in 2020.

Known as Stock Slices, Schwab offers a service that allows you to buy a slice of one of these stocks for as little as $5. You'll also be able to place your transactions without paying a trading commission as you would for ordinary shares.

· Fidelity Investments

Stocks by the Slice, a tool offered by Fidelity Investments, is a popular way to purchase fractional shares. More than 7,000 U.S.-listed stocks and ETFs are available for purchase for only $1. If you own stocks or ETFs, you can reinvest your earnings in more, even fractional, shares without incurring any additional trading fees.

· Interactive Brokers

Interactive Brokers is an excellent solution for folks who don't have the financial means to invest in total stocks. To purchase fractional shares, you must use either the broker's Pro platform or the broker's Lite platform (free of charge). The program is only available to stocks having a daily turnover of at least $10 million or a market value of at least $400 million to participate.

· Robinhood

Since its inception, Robinhood has been recognized for its zero-commission trading (including options). You can also acquire fractional shares of a company's stock through them.

A millionth of a share of your favorite stock is possible to purchase, and there is an enormous selection of equities available. ETFs for fractional shares are available for stocks trading over $1 per share and a market capitalization larger than $25 million.