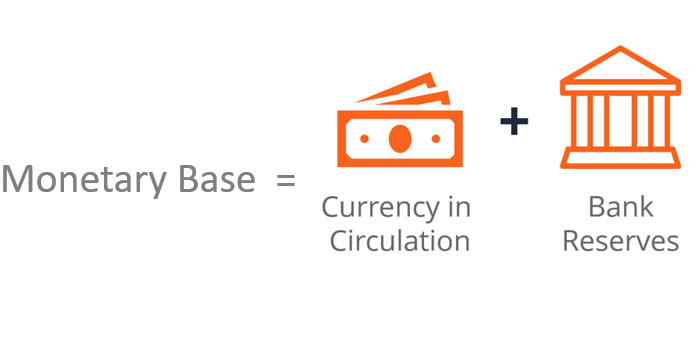

The base of the monetary system (or the M0) is the total value of currency or is in general circulation within public hands general public or is in the form of commercial bank deposits in the reserve of the central bank. Many people have been asking, what Is the Monetary Base? This measurement of the money supply is rarely used because it doesn't include other forms of money that are not a currency but which are common in today's economy.

Brief History

When gold was used as a currency, gold coinage was the basis of monetary exchange. The creation of money was mainly within the control of private companies. The state issued it or printed the documents that were used for trading its value, while the private business mining the ore reaps the rewards of mining. The entire amount produced was not subject to State control. However, the relative lack of gold was able to keep its value in exchange in a satisfactory range most times. The state was required to take some of the money bases by imposing taxes and fees on the common.

Today's monetary base is created through inconvertible notes issued by the Federal Reserve and bank credits issued by the Fed that can be exchanged in exchange for notes upon demand. After they announced that the U.S. ended the use of gold as a currency for its domestic use in 1933, all restrictions regarding being able to issue base currency were effectively lifted. The state can now spend unlimited amounts in the form of the base currency and has a complete absolute monopoly over its creation.

Understanding the Monetary Base

This is typically determined through the central bank, which regulates the current flow within the economy. It's easy to imagine that monetary base in terms of the physical currency in circulation, no matter if it's inside your purse or in the bank's vault. In contrast to the money supply, the monetary base comprises money and deposits in cash, including coins, banknotes, and coins stored by commercial banks, as well as cash in reserve accounts at banks. In certain instances, the monetary base could be called M0, or money base, or the base of money.

The Importance of The Base Monetary

Central banks may boost or reduce the base of their monetary reserves through different forms of money-related policy. In the case of many central banks, the base is increased by the purchase of bonds issued by a government or open market operation. Through the purchase of bonds at commercial banks, the central bank is able to replace the bonds in liquid form by depositing cash in the reserve account of the bank.

Central banks are also able to raise reserve requirements. These are conditions on the amount of reserves banks have to keep in reserve accounts. In the event of an increase in the amount of cash, available market interest rates will fall. Thus, it is necessary to adjust the monetary base. Is it another instrument central banks utilize to adjust the interest rates? Utilizing monetary policy to keep the base of monetary funds' central banks also assures that a stable quantity of cash is accessible.

Monetary Base &'' Money Supply

The monetary base represents the most liquid type of currency of a nation, such as coins and banknotes. The money supply is more of the picture. The money supply is the entire financial base, as well as other assets that are less liquid form. To accurately capture the range of assets in the money supply, it's classified into M0, M1 or M2, M3, or even M4.

The total amount of money in the monetary base is recorded at one level lower than the money supply. The main difference between the financial base of a country and its cash supply of a country is while it is the former account for the assets that are most liquid to be used immediately in a particular country, and the latter account for the entirety of a country's assets, including more liquid assets.

The Management of Monetary Bases

The base of monetary funds in any country is overseen or managed by that country's central bank. The central bank is entrusted with the responsibility to increase (increase) and expand (increase) or contract (reduce) the base of monetary funds due to the unique circumstances of the current economic environment. With the right monetary policies, the central bank is able to manage the base of the monetary account effectively. Many countries have open market operations in which the government purchases and sells bonds that could be employed to maintain the desired amount of base of the monetary policy.

Conclusion

At the household level, the monetary base comprises the coins and notes belonging to the household and any funds in accounts for the deposit. The cash amount of a household can be expanded to include available credit through credit card portions that are not used on credit lines and any other funds available which can be converted into an obligation to repay.